LEAP®

Leap offers a unique model for managing personal finance that calculates every move and keeps financial professionals connected with their clients every step of the way.

The Leap Model®

Leap strategists and their clients work together to incorporate client data into Leap's celebrated protection, growth and savings diagram, better known as The Leap Model.

Leap enables both clients and financial professionals to see the entire financial life at a glance, making coordination and wealth management a straightforward, uncomplicated process.

Leap Systems

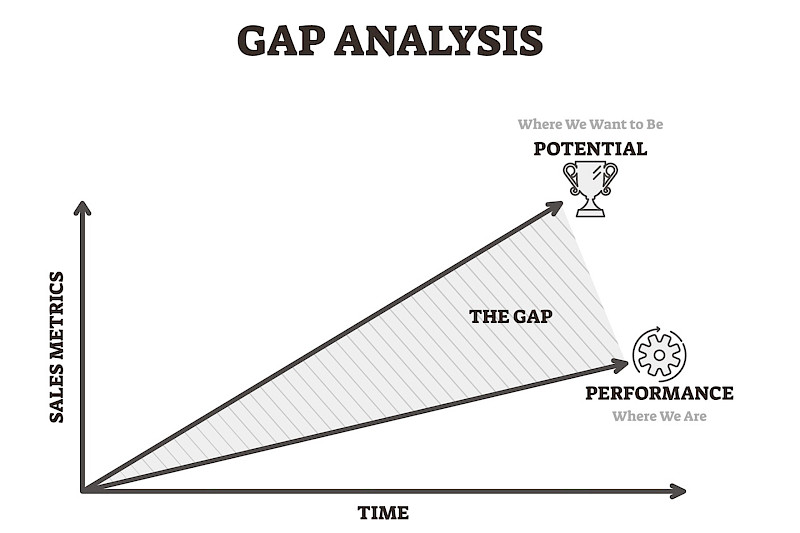

Like it or not, bank fees, government taxes, market volatility and more chip away at money and assets. This problem stretches far beyond the actual cost of the fees and penalties; it results in lost opportunity costs. What else could have otherwise been done with that money? The Leap Model helps you see the lost opportunity costs working against your wealth, and in turn, offers strategic ways to overcome them.

Looking at every aspect of the financial picture is one of the key components of the Leap approach. It's a simple idea that is so often overlooked in the financial arena. From debt to savings and investments to insurance, each part is separately analyzed, striving to maximize every asset's efficiency and productivity.

With Leap's interactive tools, clients and professionals are able to communicate and stay on the same page – even when they’re not physically together. Wealth protection, asset management and financial growth aren’t simply a “behind the scenes” activity with Leap. They all come together as a transparent coordinated effort that can be seen by both the client and their financial professionals in a way that simplifies personal finance and aims to make the most of a client’s potential.

The Leap Difference

"I became Leap licensed in 1994 and have been 100% exclusive to the Leap process ever since. The Leap Model allows me to organize my clients' financial lives in an efficient, simplistic way. Leap strategies provide my clients with protection without asking them to spend much, if any, additional money."

Interested in learning more about how 1847Financial can support your practice?

JOIN 1847FINANCIALThe content within this website is for educational purposes only and should not be construed as investment advice. It is important to note that the implementation of any strategies provided as a part of LEAP are designed to aid one in reaching their financial objectives, but no assurance can be made that these objectives will in fact be reached. Individual results may vary. LEAP is independent of HTK. The views expressed are those of the presenting party and do not necessarily reflect the views of HTK or its affiliates.

LEAP®, Leap-The Model for Financial Success™, The Leap Model™, Macro Manager™, Personal Macro Economics Process™, Wealth In Motion®, Protection, Savings, and Growth Model®, and Lifetime Economic Acceleration Process™ are trademarks and service marks of Leap Systems, LLC which is an independent affiliate of Penn Mutual Life Insurance Company (PML). HTK is a wholly owned subsidiary of PML. Trademarks belong to their respective owners.